Here at Graphite, we put together a free downloadable Chart of Accounts example that takes into account all of these best practices. And we split it out by industry for even quicker time-to-value for you. Within each of the three categories mentioned earlier, we recommend splitting your costs into people vs. non-people costs. Your people are one of your greatest investments, and also one of your costliest investments. You want to be able to analyze the money you’re spending on labor to determine your future decisions.

What is Chart of Accounts (COA): A Complete Guide With Structure & Examples

It helps organize financial information into different categories, like what the company owns, what it owes, and where it gets money from. Knowing the basics of the COA, businesses can better understand their finances and make smarter decisions. So, a chart of accounts, as mentioned, organizes a company’s finances in an easy-to-understand way. It helps everyone in the company know exactly where the money is coming from and where it’s going.

How the chart of accounts became a standard practice?

He frequently speaks at continuing education events.Charles consults with other CPA firms, assisting them with auditing and accounting issues. Second, let’s see how the journal entries feed into the general ledger which feeds into the trial balance. Yes, each business should have its own Chart of Accounts that outlines the specific account categories and numbers relevant to their operations. Add new accounts throughout the year but wait till the year ends to delete old accounts. In that case, it is typically recorded with numbers starting with a five, and expenses are recorded starting with a six. We support thousands of small businesses with their financial needs to help set them up for success.

Improve Your Reporting

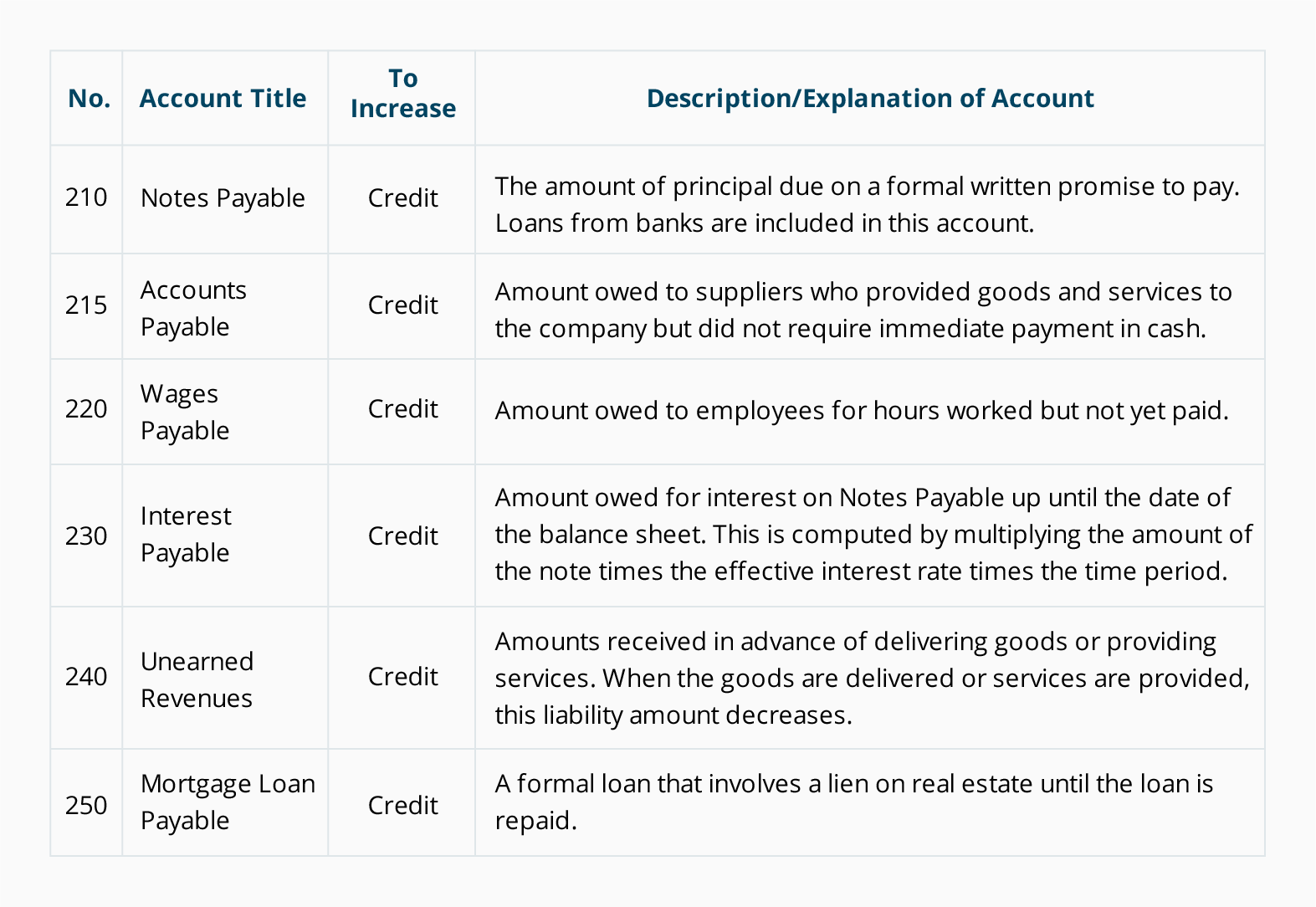

Before there was accounting software, accountants used this coded method to organize the chart of accounts on paper. Some charts of accounts use four digits is purchase return a debit or credit instead of three, but the first digit remains the same. You can use four-digit codes—assets (1000 to 1999) and liability accounts (2000 to 2999).

Asset accounts can be confusing because they not only track what you paid for each asset, but they also follow processes like depreciation. There are a few things that you should keep in mind when you are building a chart of accounts for your business. As you can see, each account is listed numerically in financial statement order with the number in the first column and the name or description in the second column. This granularity aids in precise tracking and management of finances.

- I have primarily audited governments, nonprofits, and small businesses for the last forty years.

- It helps organize financial information into different categories, like what the company owns, what it owes, and where it gets money from.

- The COA also includes accounts for online payment systems to monitor digital transactions.

- The account number in the chart of accounts varies with every business.

- Studies show that businesses that maintain a well-organized COA are better equipped to analyze their financial health and are more likely to make profitable decisions.

While Pacioli’s work laid the foundation for modern accounting, a standardized chart of accounts had yet to emerge. The COA, in this case, might include revenue accounts like Service fees and Consulting revenue to track earnings. An expense account named Professional fees can be added to monitor costs for hiring professionals.

So, separating these additional accounts allows businesses to understand the specific drivers of their financial performance in more detail. Other Comprehensive Income includes gains and losses that have not yet been realized but are included in shareholders’ equity. Separating Other Comprehensive Income allows businesses to track changes in the value of certain assets or liabilities over time.

HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. Modern accounting systems offer tools for automating data entry, generating reports, and even suggesting account categorizations based on transaction types. Each category should reflect the operations and financial activities of your business. Larger businesses might also need more detailed categories or sub-categories to accommodate diverse transactions and departments. The following examples illustrate how a fictional business—XYZ—might record transactions in its chart of accounts.